#GradStudentTax: What it is and how it could impact you — Updated 12/21/17

Update 12/21/17: Protests from graduate schools and their students had their intended effect, as the final version of this tax bill does not contain a graduate student tax. It is also worth noting that the general public has expressed dissatisfaction with this bill; for more information on this, we recommend this CNN poll. For live updates about the progress of the tax bill, we refer readers to this Wall Street Journal live blog.

Update 12/4/17: The US Senate version of this tax bill, passed on 12/1/17, does not include the graduate student tax discussed in this post, making the impending reconciliation of the House and Senate bills the decision to watch, and if you are so inclined, to let your Congresspersons and Senators know your views (To call your House/Senate representative: 202-224-3121). Here is a full update from Inside Higher Ed.

It’s likely that many of our U.S. readers have seen info about the “grad student tax” buzzing around their newsfeeds in recent weeks. We felt it would be beneficial to do a round-up of the best pieces about the issue, for those of us who need to play catch-up on the news. Here we present a group effort in which we curate posts from other outlets, share personal stories, and provide the essentials you need to be informed on the topic.

What is it?

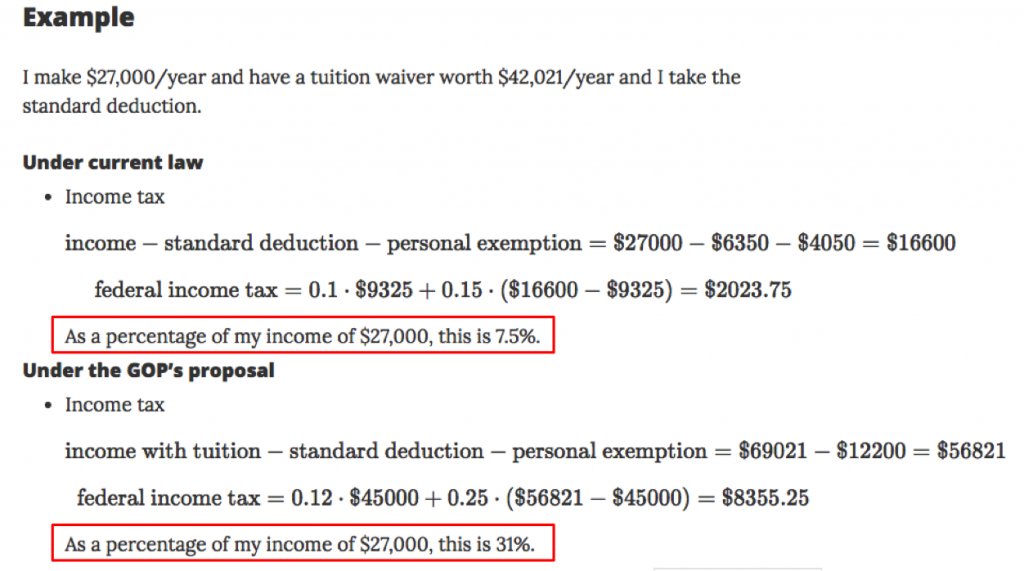

Formally called the ‘Tax Cuts and Jobs Act,’ the House voted on November 16, 2017 to pass their version of a tax reform bill. Part of the bill includes cuts to tuition waivers. Most graduate schools use tuition waivers to cover most or all of their students’ tuition. Currently, graduate students are taxed on only their stipends, but these reforms would result in many students being taxed on the sum of their stipend and the tuition value. This online calculator is a good quick way to see how the change would impact your personal finances.

So the House already passed it…what about the Senate?

We can expect that the Senate will vote on their version of the bill sometime this week. There are some key differences between the house and Senate versions of the bills. Keep an eye on the news for how their final version and vote will shake out, and read the following to learn more about what’s already been happening in the Senate:

Senate releases tax bill text in ‘unusually fast’ march to vote

Trump touts ‘big week for tax cuts’ as Senate GOP nears critical vote

How would this actually change graduate student lives?

Effectively, graduate student taxable income would increase, likely to levels which would be near-impossible to maintain without taking out loans. PhD student Vetri Velan writes that, a Ph.D. student at a public university would see their taxes go up by 30-60%, and a student at a private university would see their taxes increase by a factor of 2-4.

For a detailed example of how these changes would work, we recommend reading this post from Benjamin Ide. See his math below:

Our writer Rosa Li also raises a good point concerning how the impact of this issue would be felt over time in graduate school:

“In my last few years in my PhD program, I was not taking any classes, just conducting research and working on my dissertation. I was still charged ~$10,000/year in tuition to be an enrolled student, despite never being in a classroom. I also spent a semester abroad visiting another lab, and my home institution still “charged me” over $3000 in tuition when I wasn’t even in the country, much less on campus.

“I had not paid attention to those tuition fees before since they were fully covered by my fellowships, so they didn’t affect my financial bottom line in any way under our previous tax structure. Under the new plan, however, I would have had an additional $10,000 of taxable tuition waiver income when I was acting more as a laboratory employee than as a classroom student.

To call your Senator and let them know your stand on this proposed change in the US tax law, the telephone number (US Senate Directory) is 202-224-3121. Do it immediately to let your voice be heard before this week’s expected vote.

Roundup of the best articles

Be ready to converse on the subject with friends and family by catching up through these articles, curated by our writers:

NPR: Grad Students Would Be Hit By Massive Tax Hike Under House GOP Plan

Nature: Graduate Students Face Alarming Tax Hike

New York Times: The House Just Voted to Bankrupt Graduate Students

CNBC: House GOP tax plan would increase taxes for graduate students by roughly 400 percent

The Chronicle of Higher Education: How the GOP Tax Plan Could Hurt Graduate Students – and American Research

Baltimore Sun: Taxing grad students means fewer of them

Time Magazine: Graduate Students Sound Alarm on Huge Increases Under GOP Tax Plan

The moral of the story is that it pays to be informed with how the tax code will change, as it is very possible it will specifically impact graduate students. Use this post as a guide for learning about the issue, and keep tabs on #gradschooltax and #gradstudenttax on Twitter for up-to-the-minute news on this developing story.

Featured Image: Depiction of the Tax Cuts and Jobs Act changes created by Lego Grad Student, originally shared on Twitter. Shared here with permission from the author.

References

Benjamin Ackerman, ShinyApps, “How Will the House Tax Bill Impact Graduate Students?” https://benjaminackerman.shinyapps.io/GOPtax2017/

Alan Rappeport, The New York Times, “The House and Senate Still Have Very Different Tax Bills. Here’s How They Compare.” November 16, 2017. https://www.nytimes.com/2017/11/16/us/politics/the-house-and-senate-still-have-very-different-tax-bills.html?rref=collection%2Fsectioncollection%2Fpolitics&_r=1

Sahil Kapur, Bloomberg, “Senate Releases Tax Bill Text in ‘Unusually Fast’ March to Vote,” November 21, 2017. https://www.bloomberg.com/news/articles/2017-11-21/senate-releases-tax-bill-text-in-unusually-fast-march-to-vote

Julia Manchester, The Hill, “Trump touts ‘big week for tax cuts’ as Senate GOP nears critical vote,” November 26, 2017. http://thehill.com/homenews/administration/361901-trump-touts-big-week-for-tax-cuts-as-senate-gop-nears-critical-vote

Vetri Velan, “How Does the ‘Tax Cuts and Jobs Act’ Affect Ph.D. Students?” November 4, 2017. https://drive.google.com/file/d/1e3oIk8AO9F_UL98z5cieKha1V5e9azzB/view

Benjamin Ide, “Tax changes for graduate students under the Tax Cuts and Jobs Act.” November 5, 2017. https://bcide.gitlab.io/post/gop-tax-plan/

[…] Source: #GradStudentTax: What it is and how it could impact you […]